Learn all about structured settlements in 2025. Explore how they work, pros and cons, tax benefits, top companies, and how to sell for a lump sum. Video link -> SS

🧾 What is a Structured Settlement?

A structured settlement is a financial or insurance arrangement in which a claimant agrees to resolve a personal injury or wrongful death lawsuit by receiving periodic payments over time rather than a lump sum. These payments are typically made through an annuity purchased by the defendant or their insurer.

Real-Life Example

Suppose you win a $1 million personal injury lawsuit. Instead of receiving all the money upfront, the court may award it as:

- $50,000 immediately

- $5,000/month for 15 years

This setup ensures financial stability, especially if you have long-term medical needs.

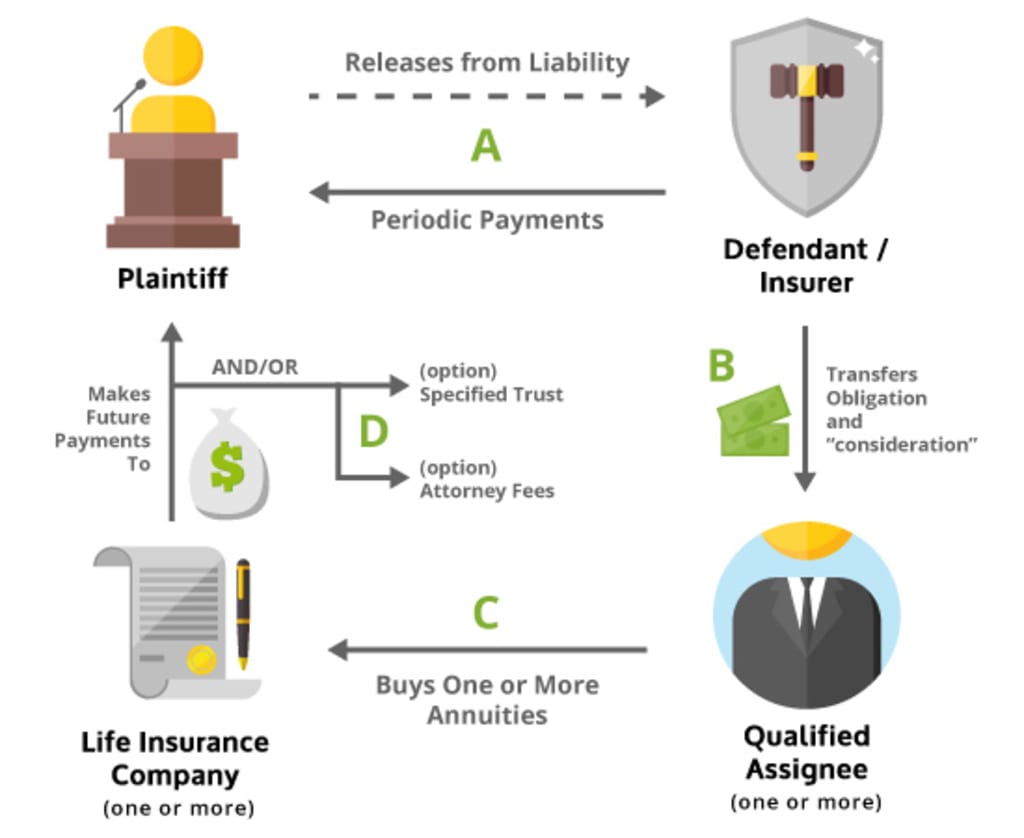

⚙️ How Does a Structured Settlement Work?

A structured settlement typically results from:

- Personal injury lawsuits

- Workers’ compensation cases

- Wrongful death claims

- Product liability settlements

Once both parties agree, the defendant (or their insurance) purchases an annuity from a life insurance company. This annuity funds the structured settlement payments.

Types of Payment Schedules

- Monthly payments

- Annual lump sums

- Medical expense coverage

- College tuition payments

These schedules can be customized based on the recipient’s needs and future plans.

🔄 periodic payments vs Lump Sum

When awarded damages, claimants often choose between a structured settlement or a lump sum payout. Here’s a comparison:

| Feature | Structured Settlement | Lump Sum |

|---|---|---|

| Tax-Free? | Usually yes | May be partially taxed |

| Liquidity | Limited | Full access |

| Risk of Overspending | Low | High |

| Long-term Security | High | Low |

| Investment Control | Low | High |

Best for: Long-term security, children, medical expenses

Not ideal for: People who need immediate access to full funds

✅ Benefits of a periodic payments

1. Tax Advantages

Under U.S. tax law, periodic payments payments from personal injury claims are generally tax-free.

2. Long-Term Financial Security

Payments are guaranteed for years—or even a lifetime—ensuring a reliable income stream.

3. Customized Plans

You can design payments to align with:

- Medical treatments

- College tuition

- Retirement

4. Protects Against Poor Spending

Because funds are received gradually, the risk of squandering a large lump sum is eliminated.

5. No Management Fees

Unlike investment accounts, there are typically no fees or commissions to manage the annuity.

❌ Disadvantages of periodic payments

While structured settlements offer safety and predictability, they’re not always ideal.

1. Lack of Flexibility

Once set, you cannot change your payment schedule without court approval.

2. Inflation Risk

If inflation rises faster than your payment increase (if any), your money loses value over time.

3. No Access in Emergencies

If you suddenly need a large amount (e.g., for surgery or home purchase), your money is tied up.

4. Selling Comes at a Cost

To sell your structured settlement, companies buy your future payments at a discounted rate—you won’t get the full value.

💸 How to Sell Your Structured Settlement

Selling your structured settlement (called a transfer of structured settlement payments) is legal but regulated.

Step-by-Step Process:

- Get a quote from structured settlement buyers

- Evaluate the discount rate they offer

- Hire an attorney (optional but recommended)

- Get court approval

- Receive the lump sum payment

When You Might Sell:

- Emergency medical costs

- Down payment for a home

- Paying off debt

- Launching a business

Pro Tip: Only sell a portion of your payments to retain some future income.

🏆 Top Structured Settlement Companies in 2025

Here are the most trusted companies if you’re looking to sell your periodic payments:

1. J.G. Wentworth

- Most well-known in the industry

- 25+ years of experience

- High approval rate

2. Peachtree Financial

- Competitive lump sum offers

- Fast processing

- Transparent fees

3. Fairfield Funding

- Specializes in partial purchases

- Offers free quotes with no pressure

4. Stone Street Capital

- Great for large settlements

- Strong customer support

5. Olive Branch Funding

- High satisfaction rating

- Personalized service

🟢 Always compare offers and read reviews before signing!

🧾 Tax Implications of periodic payments

Generally Tax-Free:

If your periodic payments arises from:

- Personal injury

- Physical sickness

- Wrongful death

Then your payments are tax-exempt, under IRC Section 104(a)(2).

When It Might Be Taxed:

- Punitive damages

- Interest income

- Investment proceeds from lump sum payouts

💡 Always consult a certified tax advisor before selling or cashing out.

❓ FAQs About Structured Settlements

Q1: Can I sell part of my periodic payments?

Yes. Many companies allow partial sales so you keep receiving future payments.

Q2: Is a periodic payments better than a lump sum?

It depends. If you need financial discipline and long-term income, structured is better. If you want investment flexibility, lump sum may be ideal.

Q3: Is selling my settlement legal?

Yes. But court approval is mandatory in most U.S. states to protect your interests.

Q4: How much will I lose if I sell?

You’ll typically receive 50–80% of the value of future payments due to discounting and fees.

Q5: How long does it take to receive money?

It may take 30–90 days, depending on court approval and documentation.

🏁 Final Thoughts

Structured settlements provide peace of mind through steady income and tax-free benefits. However, they may not always align with your life changes or financial goals.

If you’re considering a lump sum, evaluate the offer carefully and consult with legal and financial experts. The key is to balance your current needs with future security.

👉 Call to Action

Thinking of selling your periodic payments?

✅ Get a Free Quote Today — Compare offers and maximize your payout!